Almost 400,000 people who were mis-sold loans by payday lender Wonga will get less than FIVE per cent of the compensation they are owed

- All unsecured creditors will be paid 4.3 per cent over the next four weeks

- Wonga had faced a barrage of criticism over the high interest it charged

- In 2014 firm wrote off £220m worth of debt belonging to 330,000 customers

Almost 400,000 people who were mis-sold loans by payday lender Wonga will get less than five per cent of the compensation they are owed.

The firm collapsed in 2018 and nearly 400,000 eligible claims were lodged against the lender.

Wonga’s administrators, Grant Thornton, said they would be paying all unsecured creditors 4.3 per cent of their agreed claim over the next four weeks.

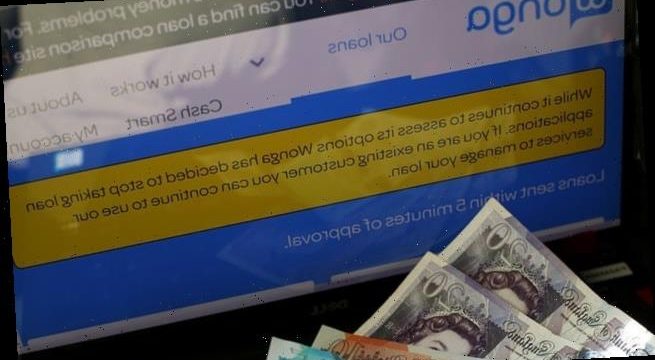

Wonga had faced a barrage of criticism over the high interest it charged on loans and was accused of targeting those who were most vulnerable.

Administrators for Wonga said claimants will get less than 5 per cent of the total owed

In 2014, the firm introduced a new management team and wrote off £220 million worth of debt belonging to 330,000 customers after admitting making loans to people who could not afford to repay them.

Administrators had received 389,621 eligible claims from those said to have been sold unaffordable loans as of August 2019, according to documents filed with Companies House.

In the month before its collapse in August 2018, the company said its struggles were due to a ‘significant’ increase industry-wide in people making claims in relation to historic loans.

In October last year another payday lender, QuickQuid, also collapsed into administration after thousands of complaints for customers.

QuickQuid, which is owned by US parent Enova, was be shut after it failed to reach a deal with regulators over an avalanche of compensation claims made against it.

Along with other payday lenders, the firm faced accusations that it preys on people in financial difficulties by granting them small loans at sky-high interest rates.

It is feared the company’s closure will leave thousands with complaints against it in limbo, with regulator the Financial Ombudsman Service yesterday unable to confirm whether they could still be pursued [File photo]

Source: Read Full Article