THOSE who haven’t received a stimulus check and need to give their banking information to the federal government have until May 13 to do so.

The Internal Revenue Service (IRS) said on Friday that those who qualify for and want the $1,200 coronavirus relief payment have until Wednesday to submit their information online.

"We're working hard to get more payments quickly to taxpayers," IRS Commissioner Chuck Rettig said in a statement.

"We want people to visit Get My Payment before the noon Wednesday deadline so they can provide their direct deposit information.”

He added: “Time is running out for a chance to get these payments several weeks earlier through direct deposit."

After the Wednesday deadline, the government will start sending paper checks that will get to Americans in later May and in June.

To fill out your information, visit: IRS.gov/coronavirus/get-my-payment.

Once there, click “Get My Payment” and fill out the appropriate information that the IRS needs to send you the relief payment via direct deposit.

The website will ask for a Social Security number, date of birth, street address, and zip code.

It will also ask for 2018 or 2019 tax return and banking information so the money can be directly deposited into bank accounts.

The “Get My Payment” tool can also be used to check the status of stimulus checks.

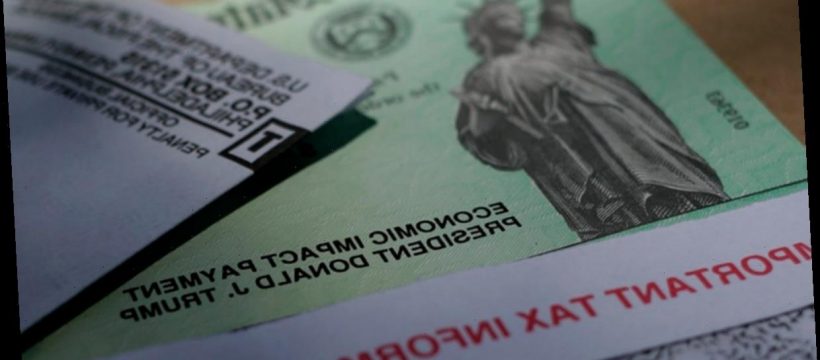

The payments are part of the $2.2trillion rescue package signed into law in March that’s aimed at combating the economic impact of the coronavirus outbreak.

Most people don’t need to do anything to get the money, and were sent the money automatically, based on direct deposit information on their previous tax returns.

Anyone earning up to $75,000 in adjusted gross income and who has a Social Security number will receive a $1,200 payment.

That means married couples filing joint returns will receive the full payment — $2,400 — if their adjusted gross income, which is what they report on their taxes, is under $150,000.

For those who make more, the payment declines: Those earning more than $99,000, or $198,000 for joint filers, are not eligible.

Parents will also receive $500 for each qualifying child.

Source: Read Full Article