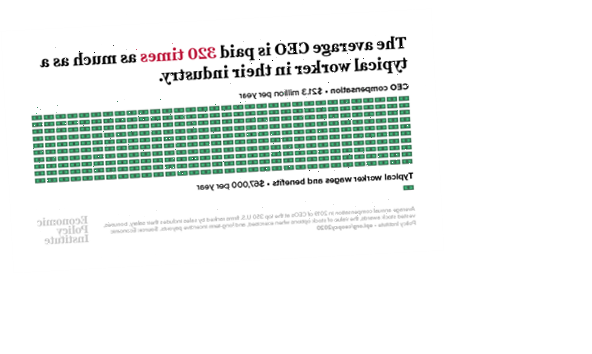

CEOs made 320 times more than what their typical worker earned last year, according to a new report from the Economic Policy Institute (EPI), part of a decades-long trend of rapidly growing compensation for corporate America’s top execs.

Total realized compensation for chief executives has grown by 1,167% in the last 40 years to $21.3 million in 2019, far eclipsing workers’ wage growth of 13.7% during that same period. That’s resulted in a widening income gap between CEOs and workers, which once stood at 21-to-1 in 1965, and reflects the worsening income inequality in the country.

“While wage growth for the majority of Americans has remained relatively stagnant for decades, CEO compensation continues to balloon,” said Lawrence Mishel, EPI distinguished fellow and co-author of the annual report that charts wage compensation since 1978. “This has fueled the spectacular income growth of the top 0.1% and 1.0% and the growth of income inequality overall.”

The stock market’s growth in recent years is behind the growing disconnect between CEO and worker wages. Unlike the rank-and-file worker whose pay is correlated to output and performance, CEO pay is largely tied to the stock performance of their company that has been buoyed by the market’s upward climb since the Great Recession ended.

Wage inflation is also to blame, Mischel said.

A board of directors determines the pay for a company’s chief executive. But “if each board considers its own CEO above average and sets their pay to be above average” therein lies “an ever ratcheting up” compensation figures, he said.

But “not everyone can be above average,” Mishel said.

Pandemic-era pay cuts

Since the onset of the COVID-19 crisis and the widespread job loss it has brought, many U.S.-based CEOs have announced they will take pay cuts or forgo their salaries for the remainder of the year.

But these announcements “aren’t serious gestures of restraining CEO compensation,” Mishel told Yahoo Money. Rather, they are PR stunts.

“CEOs offering salary cuts during the coronavirus pandemic yield press releases but no real progress toward reducing inequality and raising workers’ wages,” Mishel said.

That’s because three-fourths of salaries of the top brass are composed of vested stock awards and exercise in stock options with a paltry 6.2% of the compensation coming from salary. In other words, CEOs still earn seven figures — despite a pay cut — because they’re not abandoning their stock options.

Given the stock market’s recent activity of reaching pre-pandemic highs, CEO compensation “will probably rise further in 2020,” Mishel said.

To attempt to close the wage gap, the report’s authors suggest solutions like higher tax rates and compensation maximums. Lower CEO wages wouldn’t hurt the economy or companies, either.

“CEO pay can be curbed to reduce the growing gap between the highest earners and everyone else with little, if any, impact on the output of the economy or firm performance,” Jori Kandra, EPI research assistant and report co-author said.

Stephanie is a reporter for Yahoo Money and Cashay, a new personal finance website. Follow her on Twitter @SJAsymkos.

READ MORE:

Coronavirus puppy scams ‘seemed legit,’ ensnared dog lovers amid pandemic: Illegal Tender podcast

How much are Sen. Kamala Harris and her husband worth?

American tourists face bans and restrictions across the world amid shoddy pandemic response

Click here for more personal finance tips, guides and news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Source: Read Full Article