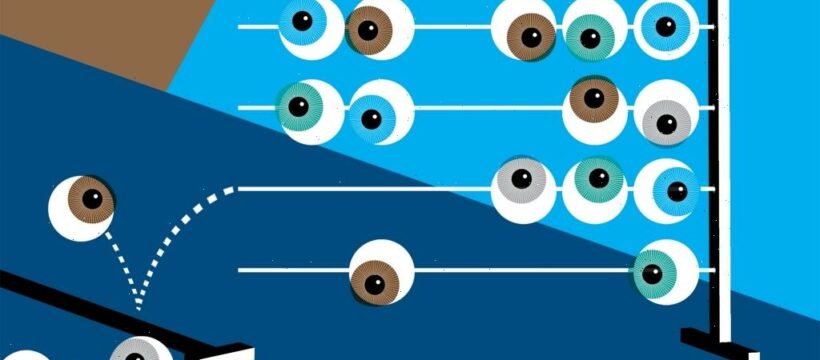

TV networks have long demanded more data from Nielsen to help keep track of viewers who are leaving traditional TV for streaming video and mobile viewing. Now they say they want less.

Nielsen recently began releasing new sets of information that include more granular measurement of TV audiences, available alongside its traditional measures of total linear viewership by age and gender. The new “big data” sets are supposed to help networks get more comfortable with such information as Nielsen prepares to transition its main gauges from counting linear audiences to tracking viewers as they move between traditional TV screens and streaming venues. The trouble? The networks believe Nielsen’s new information, “is rife with serious problems,” according to Sean Cunningham, chief executive of the VAB, a trade organization that represents the networks to the advertising industry.

The networks seek “the immediate cessation of Nielsen’s ‘Big Data’ monthly impact data releases,” Cunningham wrote in a March 8 letter to Nielsen CEO David Kenny.

The TV outlets believe Nielsen ought to reveal more about how its new data was created as well as how it compares to the information already being used in the market, says Cunningham, in the letter. “Nielsen’s release of a second data set (Big Data atop National Panel) that is intended as eventual currency data has to be halted immediately by Nielsen in order to fix this broken-on-arrival data set,” he said.

Nielsen was not able to offer immediate comment. In recent months, Nielsen has resisted recent calls from the VAB to submit its processes and data to a third party for scrutiny.

Nielsen and the networks have been jousting for months. Media companies have charged that Nielsen has not been able to count audiences properly amid the coronavirus pandemic and a large-scale shift of viewers from linear TV-watching to streaming on demand. Accreditation for Nielsen’s national and local ratings was suspended by the Media Rating Council, an industry body that works to hold audience measurement to a common standard, in September, opening the door for rivals to offer their services even as Nielsen data continues to be used.

In a letter issued in September, Nielsen’s Kenny said the company understands “that we need to move faster in advancing our measurement because the audience itself is moving faster.” Nielsen is focused on launching a new system it calls NielsenOne that would examine unduplicated viewership across traditional TV and digital platforms that it believes will be ready in coming months.

In the interim, TV networks are testing new waters with rival measurement vendors. NBCUniversal has tied up iSpot for a measurement trial that might encompass the company’s recent broadcasts of the Winter Olympics and the Super Bowl, as well as different programs airing in the first quarter. Discovery, soon to buy WarnerMedia, is working with Omnicom Media Group and two large advertisers, AT&T and State Farm, to test new ways of tabulating linear TV audiences using Comscore and VideoAmp. WarnerMedia has already unveiled a Nielsen alternative using all three of the aforementioned measurement firms, and Paramount Global is also pursuing new measurement ideas.

Even so, media buyers and other advertising executives don’t expect TV sponsors to abandon Nielsen in the next upfront market. Instead, they believe advertisers will augment their Nielsen-backed ad deals with secondary guarantees that use the rivals’ technology. Meanwhile, Nielsen is working with Disney and Interpublic Group’s Magna, among others, to test the new system it hopes to use as the basis for the next industry trading currency.

Source: Read Full Article