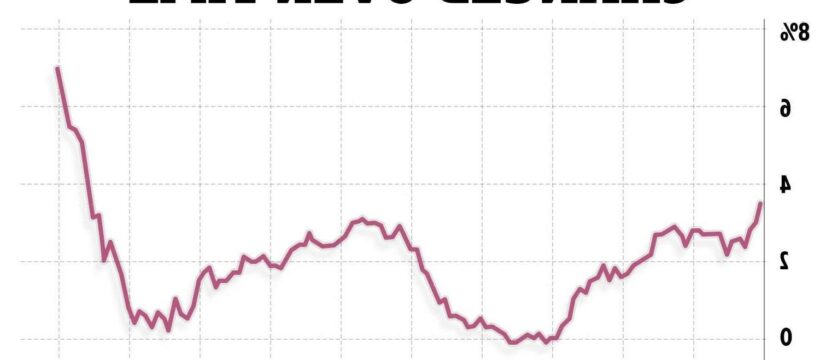

INFLATION has soared to 7% according to new data from the Office for National Statistics in another bitter blow to family finances.

The consumer price index (CPI) rose by another 0.8 percentage points in March, up from 6.2% in February.

Inflation is a measure of how much the prices of goods and services have changed over time.

When it goes up, prices on everyday items and essentials and bills also rise – which means you need to make your money stretch further.

Soaring energy bills and and petrol prices were the main drivers behind the rocketing rate of inflation, the ONS said.

Fuel prices have soared to record highs recently, mainly down to supply concerns due to the Russia-Ukraine crisis.

While millions of families have been battling against eye-watering energy price rises – with some forced into choosing between heating or eating.

The eye-watering hike means inflation is now at the highest rate since March 1992, when it stood at 7.1%.

It has increased at a faster rate than economists predicted – experts estimated that it would rise to 6.7%.

ONS chief economist Grant Fitzner said price rises saw inflation "increase sharply" in March.

He added: "Amongst the largest increases were petrol costs, with prices mostly collected before the recent cut in fuel duty, and furniture."

Commenting on the inflation rate hike, Chancellor Rishi Sunak said it was a "worrying time" for households.

He added that rising costs "could be exacerbated further by Russian aggression in Ukraine".

Mr Sunak added: "I know this is a worrying time for many families which is why we are taking action to ease the burden s by providing support worth around £22 billion in this financial year, including for the most vulnerable through our Household Support fund.

"We’re also helping as many people as possible into work – the best way for families to gain economic security in the longer term."

Experts have predicted that inflation will only continue to go up.

The Bank of England has said that inflation could peak at around 8% in April – when families saw their energy bills DOUBLE to £1,971 a year on average.

That was when the price cap – which limits how much suppliers can charge for your supply – went up.

KPMG head of consumer markets, retail and leisure Linda Ellett said: "As the cost of living continues to rise, consumers are having to cut back in order to balance their budgets.

"Sales growth on the high street shrunk in March and with increases in energy prices and national insurance this month, more people will be scrutinising their non-essential spend."

Killik & Co partner Rachel Winter said there is "no relief in sight" for families battling against rising prices.

She added: "Inflation continues its sharp rise as we enter yet another quarter of uncertainty, and the economic outlook remains murky."

How will it affect household finances?

Inflation has a double-whammy effect on households.

Firstly, you'll notice the cost of everyday essentials going up.

That means at the supermarket your weekly shop will be higher, and your bills at home will rocket too.

The average increase in prices is usually based on how much things cost today compared to a year ago.

As the rate of inflation is 7%, it means something that cost £1 a year ago will cost £1.07 today – it might not sound a lot but it soon adds up when everything goes up.

Further hurting households is the fact that wages have failed to keep up with inflation, so Brits have less in their pockets to fork out on all the rocketing costs.

Latest figures show that real terms growth in workers' pay packets has actually fallen by 1%.

If your salary hasn't kept up with the soaring rates, then you could find it harder to afford the cost of getting by.

That's because a higher rate of inflation means your money doesn't go as far and you have to spend more as a result.

The second effect of inflation is that is eats away at the value of your savings.

If inflation is higher than the interest you're earning on your savings, you are effectively losing money every year.

How to protect your finances

Household budgets will feel the squeeze as inflation soars, but there are a number of ways to buffer the blow.

You'll want to try and cut the cost of your grocery shop as food prices jump.

Hunt for yellow sticker food – this is produce that is nearing its sell by date that shops reduce to try and shift before the end of the day.

You could save up to 75% on these items.

Shopping at a cheaper supermarket and signing up to various loyalty schemes, where you can get vouchers for money off your groceries, is also worth doing.

See if you can get extra help for soaring energy bills.

Some suppliers have hardship funds you can apply to – for example, British Gas and Octopus have both set up funds to help customers who are struggling with their bills.

You could try and reduce how much energy you are using too – for example, you can reduce your bills with a simple trick such as putting foil behind your radiator.

You might be entitled to benefits to help you get by – use an online benefits calculator to make sure you're not missing out on any extra cash.

More to follow…

or the latest news on this story keep checking back at Sun Online.

Thesun.co.uk is your go to destination for the best celebrity news, football news, real-life stories, jaw-dropping pictures and must-see video.

Download our fantastic, new and improved free App for the best ever Sun Online experience. For iPhone click here, for Android click here.

Like us on Facebook at www.facebook.com/thesun and follow us from our main Twitter account at @TheSun.

Most read in Money

Source: Read Full Article