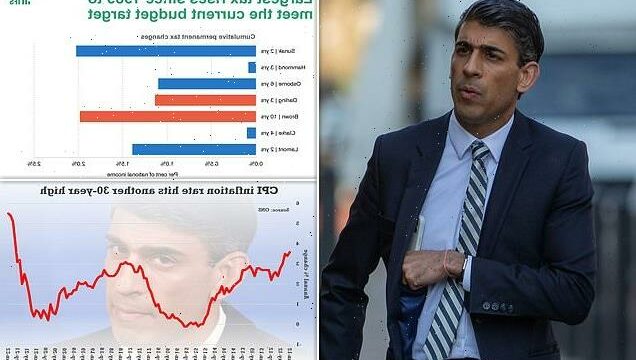

Rishi’s inflation windfall: IFS says Chancellor’s tax threshold freeze will now rake in £20BILLION a year for the Treasury rather than £8bn – meaning more pain for struggling families on top of eye-watering £13bn NI hike

- IFS says high inflation will boost the effects of Rishi Sunak’s tax threshold freeze

- Now expected to be worth £20billion a year to the Treasury rather than £8bn

- Struggling families also facing eye-watering national insurance rise next month

Rishi Sunak is set for an inflation windfall as millions of people are dragged deeper into the tax system, experts said today.

The respected Institute for Fiscal Studies think-tank said the Chancellor’s decision to freeze tax thresholds had been expected to raise £8billion a year when it was announced last Autumn.

However, since then inflation has soared, and is now predicted to peak at more than 8 per cent.

As a result the additional revenue from so-called ‘fiscal drag’ – effectively reducing the thresholds in real terms – is likely to be over £20billion a year, according to the IFS.

That is on top of the £13billion national insurance hike taking effect next month, and underlines the scale of the tax drive Mr Sunak has been forced to embark on in the wake of Covid.

He has batted away calls for early tax cuts to ease the cost of living crisis, warning that the public finances are vulnerable due to the £2.3trillion debt mountain.

There will also be extra costs for the government from debt interest and higher energy bills. But Tories seized on the IFS calculations to renew calls for cuts to fuel duty and VAT.

Rishi Sunak is set for an inflation windfall as millions of people are dragged deeper into the tax system, experts said today

Mr Sunak was already bringing in the biggest tax rises in 25 years, even before the inflationary effects on thresholds

Mr Sunak was already bringing in the biggest tax rises in 25 years, even before the inflationary effects on thresholds. He will have increased tax more in two years than Gordon Brown did in 10 years.

Tom Waters, a senior research economist at IFS, said: ‘Usually tax thresholds go up in line with inflation.

‘Last March, when the Chancellor announced a four-year freeze in income tax thresholds, inflation was fairly low and so he expected it to raise about £8billion per year.

‘Since then inflation has risen rapidly and is expected to rise even further, peaking at more than 8 per cent.

‘That means that the tax threshold freeze is now on track to be a £20.5billion tax hike – two and a half times what was originally expected.

‘And this comes on top of the £13billion increase in National Insurance contributions slated for next month.

‘This episode highlights the danger with setting tax thresholds in nominal terms for long periods of time – unexpected changes in inflation can make the size of a planned tax rise much bigger or smaller than expected.’

Senior Tory MP Robert Halfon told MailOnline that Mr Sunak should be handing back some of the extra revenue to hard-pressed workers.

‘We should give this money back through a fuel duty cut or cutting VAT. We should use the money to help those people who struggling so much up and down our country,’ Mr Halfon said.

He said Britons could face a ‘de facto lockdown’ due to being priced out of using cars, and forced to work from home.

‘It is just unaffordable. £1.50 is unaffordable, let alone £1.60,’ he said.

‘If we are not careful we will have a de facto lockdown again because people will not be able to afford to travel to work who have cars.’

CPI inflation is already running at a 30-year high and is expected to top 8 per cent

Source: Read Full Article